ETH Price Prediction: Bullish Outlook Supported by Technical Strength and Institutional Adoption

#ETH

- Technical Strength: Price above key moving average with bullish Bollinger Band positioning

- Institutional Adoption: Major firms implementing Ethereum-based solutions and significant ETF inflows

- Ecosystem Development: Google partnerships and AI integration expanding Ethereum's utility and value proposition

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

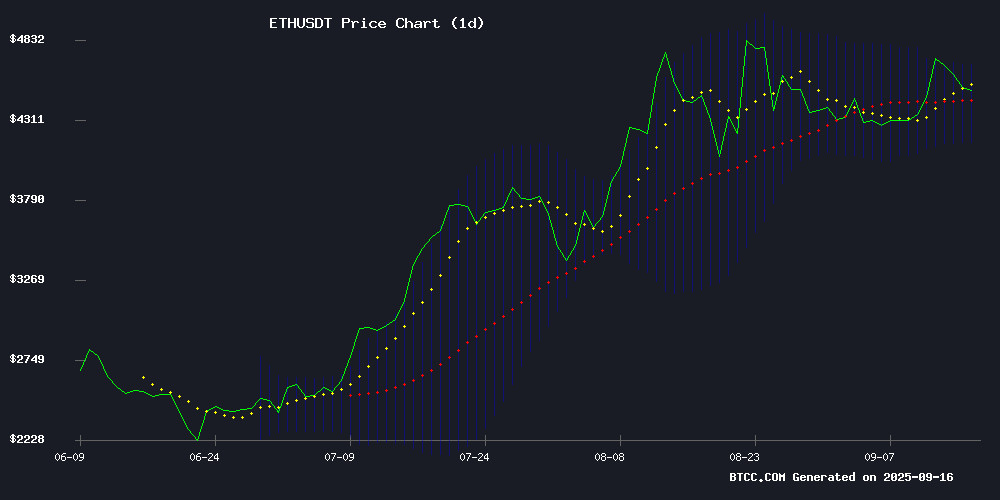

ETH is currently trading at $4,500.85, positioned above its 20-day moving average of $4,417.25, indicating sustained bullish momentum. The MACD reading of -1.46 suggests some near-term consolidation, though the overall trend remains positive. Bollinger Bands show price action NEAR the upper band at $4,672.84, signaling potential resistance ahead while maintaining support at $4,161.66.

According to BTCC financial analyst Mia, 'ETH's ability to hold above the 20-day MA combined with strong institutional inflows creates a favorable technical setup for continued upward movement toward the $4,700 resistance level.'

Market Sentiment: Institutional Adoption Drives ETH Optimism

Recent developments including Galaxy's adoption of Aave for institutional DeFi treasury management and BlackRock's ethereum ETF recording $363 million in inflows demonstrate growing institutional confidence. The collaboration between Google, Coinbase, and Mastercard on stablecoin-powered AI payments, coupled with Ethereum Foundation's new AI team launch, positions ETH at the forefront of technological innovation.

BTCC financial analyst Mia notes, 'The convergence of institutional adoption, major tech partnerships, and ongoing ecosystem development creates fundamentally strong tailwinds for Ethereum's valuation despite short-term technical indicators showing some consolidation.'

Factors Influencing ETH's Price

Galaxy Adopts Aave for Institutional DeFi Treasury Management

Galaxy (NASDAQ: GLXY), a publicly traded digital asset financial services firm, is leveraging Aave's decentralized lending protocol to optimize treasury operations and structured product development. The move signals deepening institutional adoption of DeFi infrastructure for scalable liquidity solutions.

The firm utilizes Aave's permissionless stablecoin borrowing markets—including USDC and GHO—to reduce reliance on traditional intermediaries. Aave's liquidity depth and transparent risk parameters were key factors in Galaxy's platform selection, according to project communications.

This strategic integration demonstrates how mature institutions are transitioning from speculative crypto holdings to operational blockchain integration. Galaxy's multi-pronged business lines—spanning trading, asset management, and venture investing—require real-time credit access that legacy systems struggle to provide efficiently.

SharpLink Expands ETH Treasury Amid Share Buyback Program

SharpLink Gaming (NASDAQ: SBET) has repurchased 1 million shares at an average price of $16.67, advancing its $1.5 billion buyback initiative. The Minneapolis-based firm has now acquired 1.93 million shares, totaling nearly $32 million since August.

The company's Ethereum treasury has grown to 838,152 ETH, valued at approximately $3.7 billion. This includes 922 ETH added since August and 3,240 ETH earned from staking since June, worth $14.4 million. SharpLink stakes nearly all its holdings and maintains a debt-free balance sheet.

"We remain focused on stockholder value," said co-CEO Joseph Chalom. "By increasing our ETH concentration, we align the long-term interests of SharpLink, Ethereum, and our shareholders, demonstrating the strategic use of digital assets for value creation."

Despite these efforts, SBET shares dipped 0.86% to $16.65 today, extending a 19% decline over the past month. The company continues buybacks only when its net asset value falls below 1.

Google and Coinbase Collaborate on Stablecoin-Powered AI Payments Protocol

Google has unveiled an open-source protocol designed to facilitate payments between artificial intelligence applications, leveraging both traditional finance and stablecoins. Developed in partnership with Coinbase and the Ethereum Foundation, the initiative aims to bridge the gap between crypto and conventional payment systems for autonomous AI transactions.

The protocol has garnered support from over 60 major corporations, including Salesforce and American Express, signaling broad institutional interest in crypto's role in the AI economy. Stablecoins, particularly those pegged to the U.S. dollar, are positioned as a cornerstone for seamless, human-free transactions in this emerging ecosystem.

This move reflects Google's strategic embrace of blockchain technology and its potential to underpin the next generation of digital commerce. The collaboration with Coinbase ensures robust crypto integration, while participation from traditional finance heavyweights lends credibility to the project.

Ethereum Holds Above $4,500 Amid Market Rally as FY Energy Touts 4% Daily ROI in Cloud Mining

Ethereum maintains resilience above the $4,500 threshold despite broader market volatility, buoyed by network upgrades and long-term holder conviction. The asset's recent price action reflects cautious optimism among investors who view short-term fluctuations as secondary to its structural improvements.

FY Energy emerges as a focal point for passive yield seekers, promoting cloud mining contracts with 4% daily returns. The platform differentiates itself through renewable energy-powered operations—leveraging solar and wind—while capitalizing on Ethereum's proof-of-stake infrastructure. This model appeals to holders seeking to offset portfolio volatility with consistent earnings.

Market participants increasingly bifurcate between speculative trading and infrastructure-based yield generation. FY Energy's value proposition hinges on converting idle ETH holdings into productive assets, though such models inherently carry smart contract and sustainability risks that warrant due diligence.

Ethereum Launches $2 Million Bug Bounty for Fusaka Upgrade Ahead of Mainnet Deployment

The Ethereum Foundation has initiated a high-stakes security audit contest, offering up to $2 million in rewards for identifying vulnerabilities in the upcoming Fusaka upgrade. The four-week program, hosted on the Sherlock platform and co-sponsored by Gnosis and Lido, runs until October 13. Early participants are incentivized with reward multipliers—2x in the first week and 1.5x in the second—to accelerate bug detection.

Fusaka, Ethereum's next major upgrade, aims to enhance security, throughput, and efficiency through features like PeerDAS. While the Foundation targets a late 2025 mainnet release, it acknowledges potential delays due to coordination challenges. This proactive approach underscores Ethereum's commitment to network robustness as it evolves beyond its current capabilities.

Ethereum Validator Exit Queue Hits Record 46-Day Wait Amid $11.25B ETH Backlog

Ethereum's proof-of-stake mechanism faces unprecedented strain as 2.5 million ETH—worth approximately $11.25 billion—queues for validator exits. The bottleneck, now requiring a 46-day wait time, marks the longest delay since the network transitioned to staking.

Infrastructure provider Kiln triggered the surge on September 9, withdrawing 1.6 million ETH as a security precaution following high-profile breaches including the NPM supply-chain attack. While unrelated to Ethereum's protocol, these incidents demonstrate how external crypto ecosystem events can ripple through validator dynamics.

Market forces compound the congestion. ETH's 160% rally since April has prompted profit-taking among stakers, while institutional players rebalance portfolios. This coincides with increased validator entries following the SEC's May clarification on staking regulations.

BlackRock Ethereum ETF Posts $363M Inflows, Signaling Market Shift

BlackRock’s Ethereum ETF (ETHA) recorded its largest daily inflows in 30 days, attracting $363 million on September 15. This surge marks a stark reversal from earlier outflows, pushing the fund’s trading volume to $1.5 billion. Institutional confidence appears to be rebounding as Ethereum-based products collectively manage $30.35 billion in assets.

The inflows—equivalent to 80,768 ETH—follow a challenging period that saw $787 million exit the fund earlier this month. Ethereum’s staking yield and growing adoption by digital asset treasuries are fueling speculation it could eventually outperform Bitcoin. BlackRock now commands over half of the Ethereum ETF market, underscoring its dominance in crypto investment vehicles.

Google Launches AI Payment Protocol With Coinbase & Mastercard

Google has introduced the Agent Payments Protocol (AP2), an open-source standard developed in collaboration with over 60 companies, including the Ethereum Foundation, Coinbase, Mastercard, and PayPal. Launched on September 16, 2025, AP2 aims to establish a secure framework for AI agents to manage financial transactions, addressing a critical gap in current payment systems designed for human approval.

The protocol employs cryptographic "Mandates" to verify user authorization, enabling AI-driven commerce to operate with reliability and security. AP2 supports diverse payment methods, from traditional credit cards and bank transfers to digital assets like stablecoins. Google partnered with Coinbase and the Ethereum Foundation to create the A2A x402 extension, optimized for crypto-native transfers.

James Tromans, Google Cloud's Web3 lead, emphasized the protocol's foundational design: "Built from scratch to unify legacy and emerging payment rails." This innovation positions AI systems to meet human expectations for transactional trust—a milestone for decentralized finance infrastructure.

Ethereum Foundation Launches AI Team to Pioneer New Frontiers

The Ethereum Foundation has established a dedicated AI team, dubbed the dAI Team, to explore synergies between blockchain and artificial intelligence. Led by researcher Davide Crapis, the initiative aims to position Ethereum as a foundational layer for AI's autonomous economic activities.

The team's primary focus is enabling AI agents to independently execute transactions within a decentralized framework. This approach seeks to reduce reliance on centralized platforms while providing a neutral, secure environment for machine-to-machine coordination.

By integrating Ethereum's infrastructure with AI development, the foundation envisions a machine economy where decentralized protocols govern autonomous interactions. The move reflects growing institutional recognition of blockchain's potential to transform emerging technological paradigms.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH presents a compelling investment opportunity. The price holding above key moving averages combined with significant institutional adoption suggests strong upside potential.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $4,500.85 | Above 20-day MA, bullish |

| 20-day MA | $4,417.25 | Support level holding |

| MACD | -1.46 | Near-term consolidation |

| Bollinger Upper | $4,672.84 | Next resistance level |

| Institutional Inflows | $363M (BlackRock ETF) | Strong institutional demand |

BTCC financial analyst Mia emphasizes that 'the combination of technical strength and fundamental adoption trends makes ETH well-positioned for medium to long-term growth, though investors should monitor the $4,670 resistance level for breakout confirmation.'